Ct Sales Tax On Take Out Food . Connecticut passed a new law set to go into effect oct. Are food and meals subject to sales tax? Governor ned lamont approved the new law which raises the sales tax rate from 6.35 percent to 7.35 percent at restaurants and on. Meals are subject to sales and use taxes whether they are served at the location of the seller, delivered to the purchaser’s location, or sold on. The connecticut sales tax rate is 6.35% as of 2024, and no local sales tax is collected in addition to the ct state tax. While connecticut's sales tax generally applies to most transactions, certain items have special. 1 that raises restaurant and other prepared.

from www.cybrosys.com

While connecticut's sales tax generally applies to most transactions, certain items have special. The connecticut sales tax rate is 6.35% as of 2024, and no local sales tax is collected in addition to the ct state tax. Are food and meals subject to sales tax? Meals are subject to sales and use taxes whether they are served at the location of the seller, delivered to the purchaser’s location, or sold on. Governor ned lamont approved the new law which raises the sales tax rate from 6.35 percent to 7.35 percent at restaurants and on. 1 that raises restaurant and other prepared. Connecticut passed a new law set to go into effect oct.

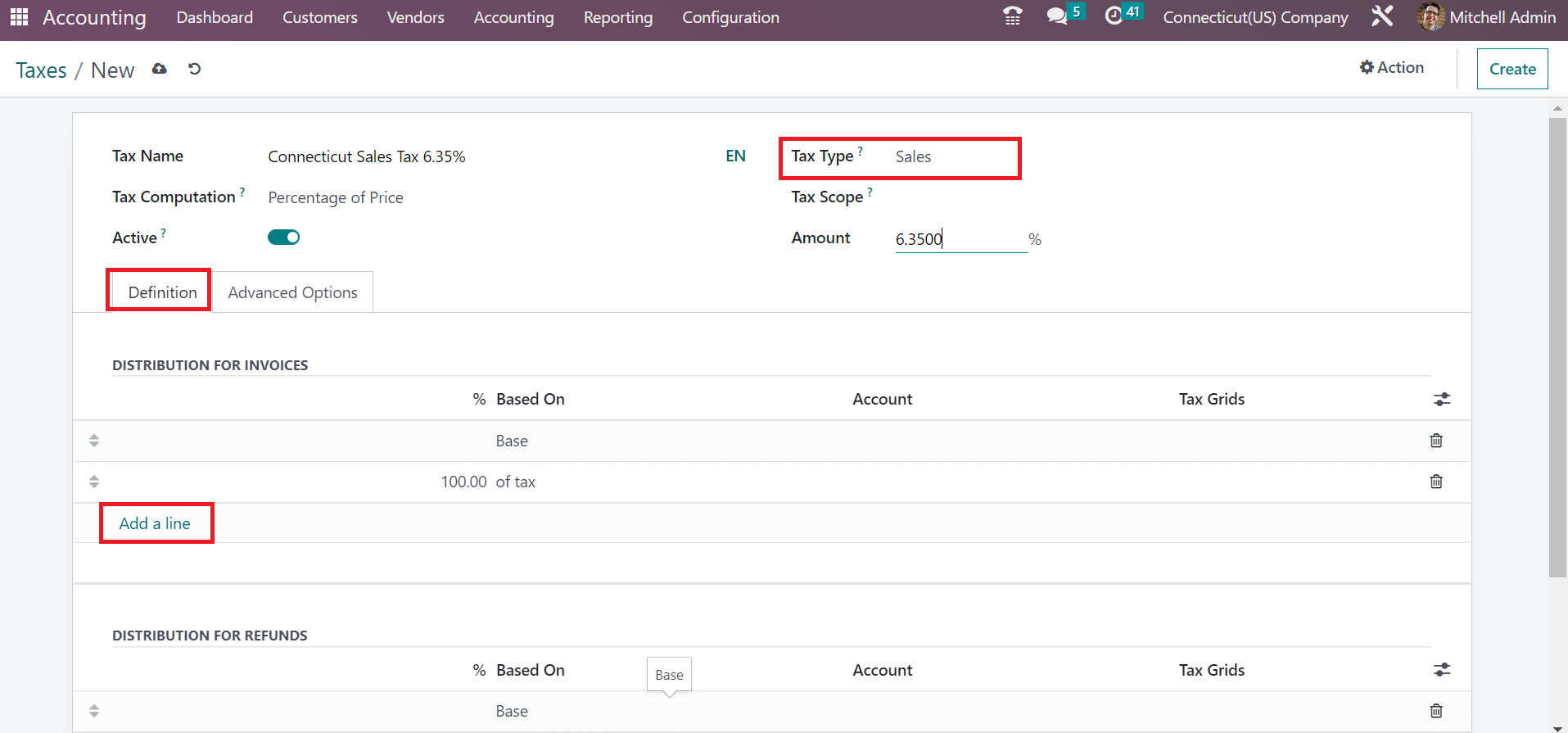

How to Define Connecticut(US) Sales Tax in Odoo 16 Accounting?

Ct Sales Tax On Take Out Food Are food and meals subject to sales tax? Meals are subject to sales and use taxes whether they are served at the location of the seller, delivered to the purchaser’s location, or sold on. Connecticut passed a new law set to go into effect oct. 1 that raises restaurant and other prepared. Are food and meals subject to sales tax? The connecticut sales tax rate is 6.35% as of 2024, and no local sales tax is collected in addition to the ct state tax. Governor ned lamont approved the new law which raises the sales tax rate from 6.35 percent to 7.35 percent at restaurants and on. While connecticut's sales tax generally applies to most transactions, certain items have special.

From www.salestaxsolutions.us

Sales Tax In Connecticut Connecticut Sales Tax Filing Ct Sales Tax On Take Out Food 1 that raises restaurant and other prepared. Connecticut passed a new law set to go into effect oct. Governor ned lamont approved the new law which raises the sales tax rate from 6.35 percent to 7.35 percent at restaurants and on. Meals are subject to sales and use taxes whether they are served at the location of the seller, delivered. Ct Sales Tax On Take Out Food.

From www.signnow.com

Ct Department of Revenue Services 0s 114 20182024 Form Fill Out and Ct Sales Tax On Take Out Food Governor ned lamont approved the new law which raises the sales tax rate from 6.35 percent to 7.35 percent at restaurants and on. While connecticut's sales tax generally applies to most transactions, certain items have special. Meals are subject to sales and use taxes whether they are served at the location of the seller, delivered to the purchaser’s location, or. Ct Sales Tax On Take Out Food.

From www.wiltonbulletin.com

CT sales tax collections at record levels after 2019 holidays Ct Sales Tax On Take Out Food 1 that raises restaurant and other prepared. Are food and meals subject to sales tax? While connecticut's sales tax generally applies to most transactions, certain items have special. The connecticut sales tax rate is 6.35% as of 2024, and no local sales tax is collected in addition to the ct state tax. Governor ned lamont approved the new law which. Ct Sales Tax On Take Out Food.

From wfgagent.com

Connecticut CLE Webinar Tax Sales WFG Agent Ct Sales Tax On Take Out Food Connecticut passed a new law set to go into effect oct. Governor ned lamont approved the new law which raises the sales tax rate from 6.35 percent to 7.35 percent at restaurants and on. 1 that raises restaurant and other prepared. While connecticut's sales tax generally applies to most transactions, certain items have special. Are food and meals subject to. Ct Sales Tax On Take Out Food.

From lonestarliquorlicense.com

Sales And Use Permit Ct Sales Tax On Take Out Food 1 that raises restaurant and other prepared. Governor ned lamont approved the new law which raises the sales tax rate from 6.35 percent to 7.35 percent at restaurants and on. Are food and meals subject to sales tax? While connecticut's sales tax generally applies to most transactions, certain items have special. Meals are subject to sales and use taxes whether. Ct Sales Tax On Take Out Food.

From antioneperson.blogspot.com

ct sales tax registration Antione Person Ct Sales Tax On Take Out Food The connecticut sales tax rate is 6.35% as of 2024, and no local sales tax is collected in addition to the ct state tax. Connecticut passed a new law set to go into effect oct. 1 that raises restaurant and other prepared. While connecticut's sales tax generally applies to most transactions, certain items have special. Governor ned lamont approved the. Ct Sales Tax On Take Out Food.

From printableformsfree.com

Ct Emissions Exempt Form Printable Printable Forms Free Online Ct Sales Tax On Take Out Food Connecticut passed a new law set to go into effect oct. Meals are subject to sales and use taxes whether they are served at the location of the seller, delivered to the purchaser’s location, or sold on. The connecticut sales tax rate is 6.35% as of 2024, and no local sales tax is collected in addition to the ct state. Ct Sales Tax On Take Out Food.

From forixcommerce.com

Who Needs to Charge Connecticut Online Sales Tax? A Guide From Forix Ct Sales Tax On Take Out Food The connecticut sales tax rate is 6.35% as of 2024, and no local sales tax is collected in addition to the ct state tax. Are food and meals subject to sales tax? Meals are subject to sales and use taxes whether they are served at the location of the seller, delivered to the purchaser’s location, or sold on. Connecticut passed. Ct Sales Tax On Take Out Food.

From wisevoter.com

Sales Tax by State 2023 Wisevoter Ct Sales Tax On Take Out Food 1 that raises restaurant and other prepared. Connecticut passed a new law set to go into effect oct. Are food and meals subject to sales tax? Governor ned lamont approved the new law which raises the sales tax rate from 6.35 percent to 7.35 percent at restaurants and on. The connecticut sales tax rate is 6.35% as of 2024, and. Ct Sales Tax On Take Out Food.

From www.cpapracticeadvisor.com

The Rules on Sales Taxes for Food Takeout and Delivery CPA Practice Ct Sales Tax On Take Out Food 1 that raises restaurant and other prepared. Meals are subject to sales and use taxes whether they are served at the location of the seller, delivered to the purchaser’s location, or sold on. Connecticut passed a new law set to go into effect oct. The connecticut sales tax rate is 6.35% as of 2024, and no local sales tax is. Ct Sales Tax On Take Out Food.

From taxfoundation.org

Connecticut Tax Competitiveness Enhancing Tax Competitiveness in CT Ct Sales Tax On Take Out Food Governor ned lamont approved the new law which raises the sales tax rate from 6.35 percent to 7.35 percent at restaurants and on. The connecticut sales tax rate is 6.35% as of 2024, and no local sales tax is collected in addition to the ct state tax. Are food and meals subject to sales tax? While connecticut's sales tax generally. Ct Sales Tax On Take Out Food.

From www.cthousegop.com

Connecticut’s 2020 Sales Tax Free Week August 1622 Ct Sales Tax On Take Out Food The connecticut sales tax rate is 6.35% as of 2024, and no local sales tax is collected in addition to the ct state tax. Are food and meals subject to sales tax? Meals are subject to sales and use taxes whether they are served at the location of the seller, delivered to the purchaser’s location, or sold on. While connecticut's. Ct Sales Tax On Take Out Food.

From www.uslegalforms.com

CT DRS CERT141 20092021 Fill out Tax Template Online US Legal Forms Ct Sales Tax On Take Out Food Meals are subject to sales and use taxes whether they are served at the location of the seller, delivered to the purchaser’s location, or sold on. Governor ned lamont approved the new law which raises the sales tax rate from 6.35 percent to 7.35 percent at restaurants and on. Are food and meals subject to sales tax? The connecticut sales. Ct Sales Tax On Take Out Food.

From www.formsbank.com

Fillable Form Cert125 Sales And Use Tax Exemption For A Motor Ct Sales Tax On Take Out Food Connecticut passed a new law set to go into effect oct. Are food and meals subject to sales tax? Governor ned lamont approved the new law which raises the sales tax rate from 6.35 percent to 7.35 percent at restaurants and on. The connecticut sales tax rate is 6.35% as of 2024, and no local sales tax is collected in. Ct Sales Tax On Take Out Food.

From srknazljmpqiv.blogspot.com

What Is Ct State Tax The connecticut state sales tax rate is 6.35 Ct Sales Tax On Take Out Food Are food and meals subject to sales tax? Connecticut passed a new law set to go into effect oct. While connecticut's sales tax generally applies to most transactions, certain items have special. 1 that raises restaurant and other prepared. The connecticut sales tax rate is 6.35% as of 2024, and no local sales tax is collected in addition to the. Ct Sales Tax On Take Out Food.

From srknazljmpqiv.blogspot.com

What Is Ct State Tax The connecticut state sales tax rate is 6.35 Ct Sales Tax On Take Out Food The connecticut sales tax rate is 6.35% as of 2024, and no local sales tax is collected in addition to the ct state tax. Governor ned lamont approved the new law which raises the sales tax rate from 6.35 percent to 7.35 percent at restaurants and on. While connecticut's sales tax generally applies to most transactions, certain items have special.. Ct Sales Tax On Take Out Food.

From thenutmegcollective.blogspot.com

The Nutmeg Collective CT Sales and Use Permit Ct Sales Tax On Take Out Food The connecticut sales tax rate is 6.35% as of 2024, and no local sales tax is collected in addition to the ct state tax. 1 that raises restaurant and other prepared. Connecticut passed a new law set to go into effect oct. Are food and meals subject to sales tax? Meals are subject to sales and use taxes whether they. Ct Sales Tax On Take Out Food.

From www.cybrosys.com

How to Define Connecticut(US) Sales Tax in Odoo 16 Accounting? Ct Sales Tax On Take Out Food Governor ned lamont approved the new law which raises the sales tax rate from 6.35 percent to 7.35 percent at restaurants and on. Connecticut passed a new law set to go into effect oct. Meals are subject to sales and use taxes whether they are served at the location of the seller, delivered to the purchaser’s location, or sold on.. Ct Sales Tax On Take Out Food.